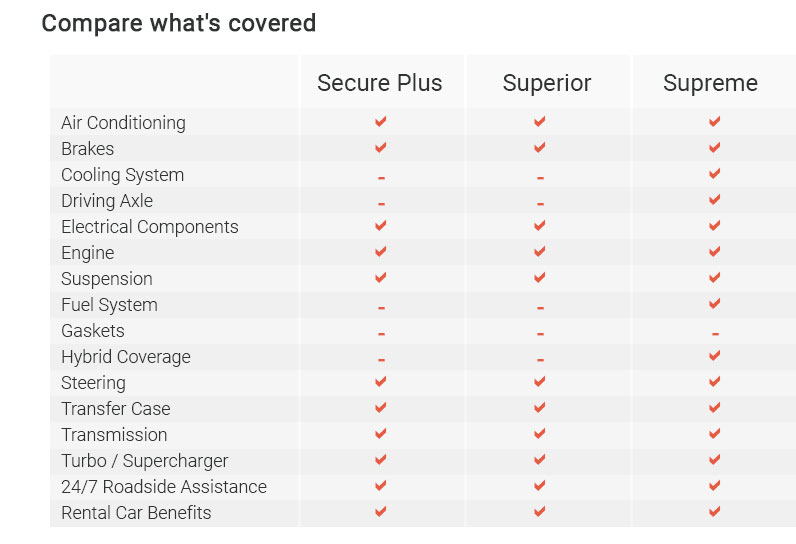

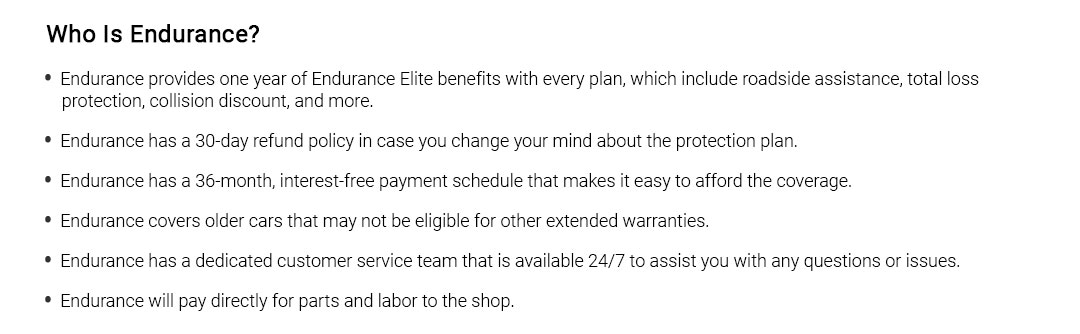

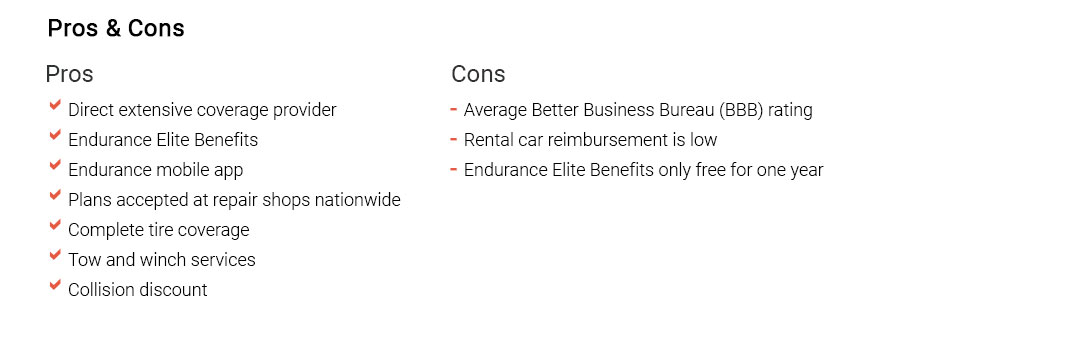

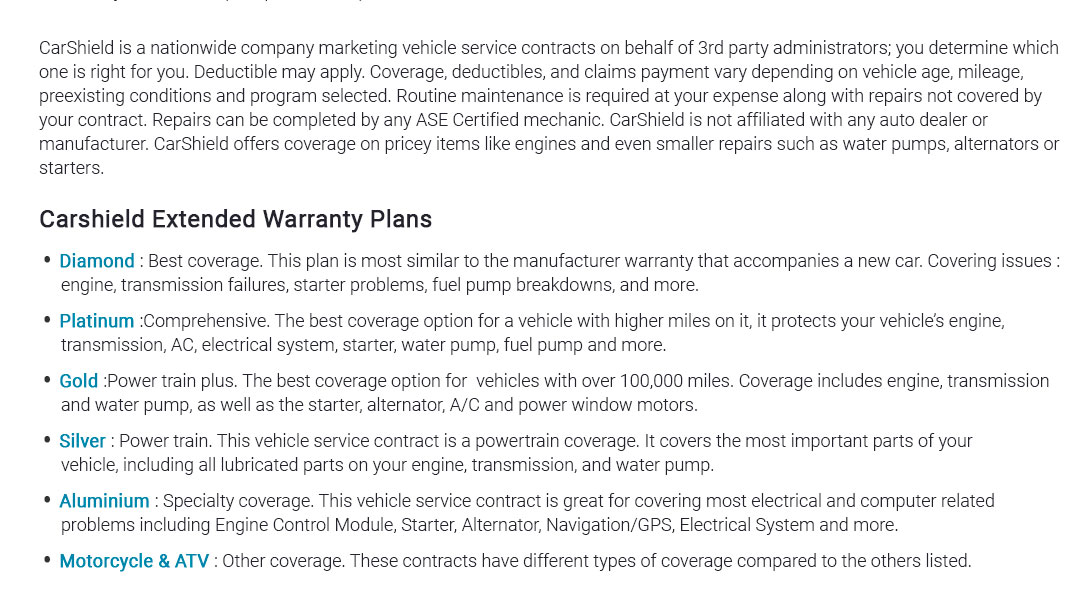

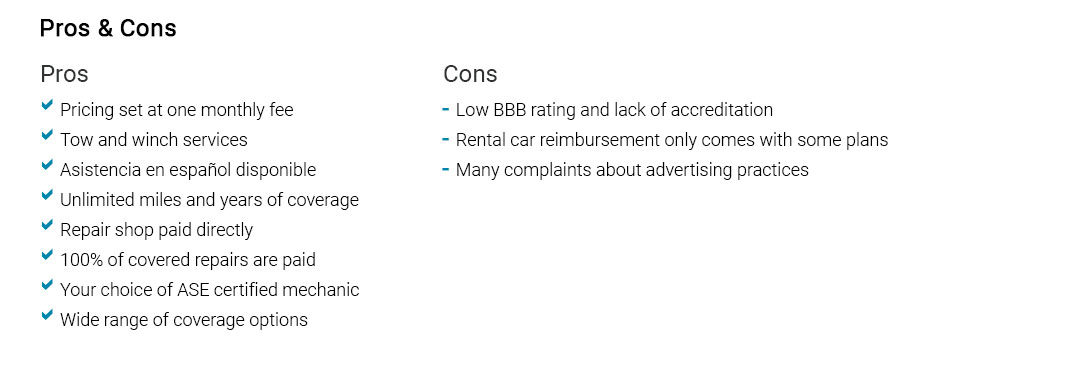

extended warranty insurance companies: a practical, result-focused guideWhat these companies actually offerThink in terms of offers and reliability. Plans vary, but the core deal is simple: you pay a fixed cost to reduce surprise repair bills later. - Coverage types: powertrain-only, stated-component, or exclusionary (closest to bumper-to-bumper; read the exclusions).

- Add-ons: roadside assistance, rental reimbursement, trip interruption, and transferable coverage that helps resale value.

- Deductibles: per-visit or per-repair; per-visit usually costs a bit more but stings less at the shop.

- Payment flow: the most reliable companies pay the repair shop directly; avoid reimbursement-only unless you keep cash reserves.

Realistic check: no plan covers routine wear items (brake pads, wipers) or pre-existing conditions; expect maintenance proof requests. Reliability signals to look for- Claim approval speed: ask average time to authorize common repairs; under 30 minutes is strong.

- Shop network: large national networks plus freedom to use trusted local ASE shops is ideal.

- Payment method: direct credit card to the shop beats "mail-in reimbursement."

- Financial backing: insurer-backed or OEM-backed programs tend to honor claims through market cycles.

- Contract transparency: sample contract available up front, with clear labor-rate caps and diagnostic coverage.

- Complaint patterns: look for repeated themes about denials tied to maintenance records or "teardown authorization."

Quick field test I useMy alternator died in a grocery store lot. I called the provider from the parking curb; they verified the VIN, phoned the shop, and issued approval in 12 minutes. The shop received a card on file; I paid a $100 deductible, kept my receipt, and left. That's the bar. Costs and valuePrice should match risk: higher mileage, turbo, luxury tech, or EV thermal systems push premiums up. Monthly plans look friendly but add fees; compare total cost of ownership. Cancellation pro-rata math matters if you sell early. - Waiting periods: 30 days/1,000 miles is common to prevent immediate big-ticket claims.

- Caps: per-visit and aggregate caps should exceed expected worst-case repairs by 25 - 40%.

- Labor rate: make sure the contract matches local hourly rates; otherwise you pay the gap.

How to compare offers- Collect three quotes: OEM-backed, insurer-backed third-party, and an administrator-only plan.

- Read the sample contract's exclusions page twice; highlight "overheating," "pre-authorization," and "improper maintenance."

- Check limits: aggregate payout, per-claim cap, diagnostics coverage, fluids and taxes.

- Pick a deductible and run the math on two real repairs (e.g., transmission and A/C compressor).

- Call support at off-hours; if hold times are brutal now, they'll be worse on a busy Monday.

Common gotchas- Denied claims for missing oil change receipts - set a calendar reminder and keep digital copies.

- Shop teardown authorization: who pays if the problem isn't covered? Get it in writing.

- Aftermarket parts clauses: some plans require OEM parts only, slowing repairs.

- Modified vehicles: tunes and lifts can void related coverage.

When an extended warranty makes sense- You plan to keep the car well past the factory warranty.

- Your budget would strain under a $2,500 - $6,000 surprise repair.

- The vehicle has known expensive failure points (air suspension, dual-clutch, infotainment).

- You need rental coverage to avoid downtime costs.

Documentation checklist- VIN, mileage, service history (receipts with dates, mileage, and fluids used).

- Preferred shop's contact info and labor rate.

- Roadside and rental coverage numbers handy in your phone.

Red flags- Pressure to "sign today for this price."

- No sample contract before payment.

- Reimbursement-only claims or ACH weeks later.

- Excessively broad wear-and-tear exclusions that swallow the benefit.

Types of extended warranty insurance companiesOEM-backed: generally the smoothest with dealer networks; may cost more but high reliability. Insurer-backed third-party: strong nationwide coverage and stable claim funds. Administrator-only: cheaper up front; reliability varies - scrutinize financial backing and payment practices. Bottom linePick the company that pairs clear offers with proven reliability: fast authorizations, direct-to-shop payments, transparent caps, and contracts you can read in ten minutes. Keep maintenance records, confirm labor rates, and test the phone line before you buy. That combination saves time, money, and stress when something actually breaks.

|

|